What is a peace of mind? Peace of mind is when asset protection, legacy planning, compliance and taxes are no longer a concern.

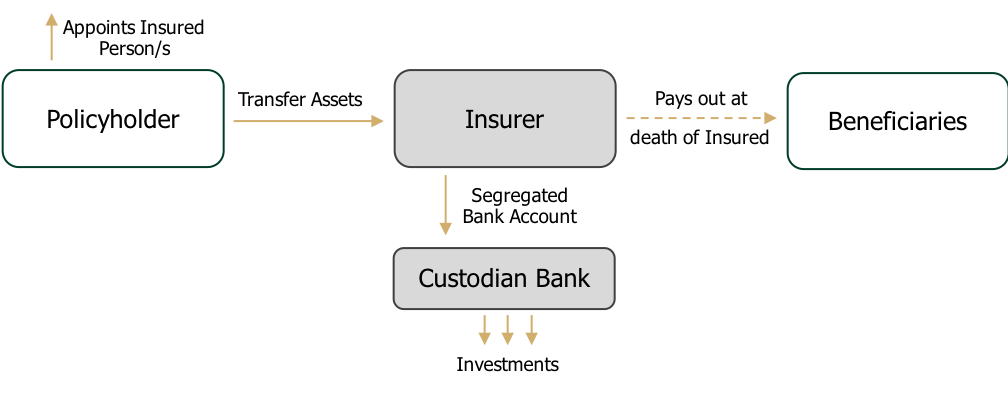

Simply put, PPLI is a multi-jurisdictional wealth planning tool available on a private placement basis to wealthy families and high net worth individuals. Tailored to each client, therefore, it is known as private placement. It is based on life insurance and annuity policies that allow for bespoke tailored and internationally diversified investment strategies.

The product is often also known as “private banking insurance” or “insurance wrappers”. In other words, PPLI presents a planning structure, just like trusts, companies, foundations and funds that allows your internationally diversified portfolio to be enveloped within the legal structure of a life insurance resulting in a series of desirable wealth planning benefits.

Depending on the investor’s domicile or nationality, a different jurisdiction and insurer should be chosen. After all, the investor is normally doing this for more protection, and therefore, he needs to make sure he is investing in a prime jurisdiction with the right tax agreements in place and with a first-class institution. The unique PPLI structure contains a system of multi-layer checks and balances, thus providing for secure global investment capacity.

At RFO, we always look for solutions that give our valued clients solid wealth management benefits.

How do you become tax-effective? How do you ensure that your nest eggs grow and they are protected for your children and grandchildren? How can you achieve all these in compliance with international laws and regulations?

These questions need to be answered. These are the questions we deal with on a daily basis.

Defining and Defending Legacies

由香港證監會第1, 第4及9類別及新加坡金融局CMS所發牌